Video

Using Optimus for trade idea generation in EURJPY

Date: 31st March, 2022

Optimus allows you to visualize the options market and make more informed trading decisions.

- First, we look to see where the EURJPY vol surface is using Single Currency Grids.

- Then we have a look at where the surface has been, using the Surface Evolution, Curve Evolution and Curve Change Grids.

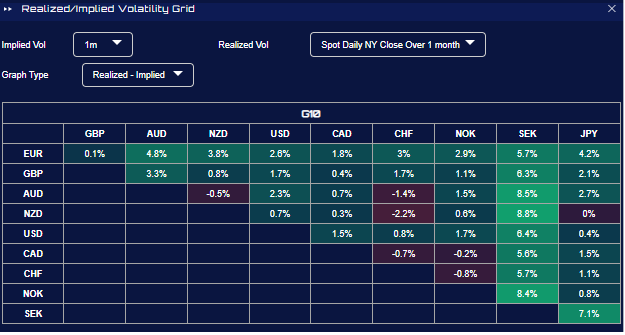

- Next, we examine how realized vol is performing using the Realized/Implied Volatility Grid using daily closes.

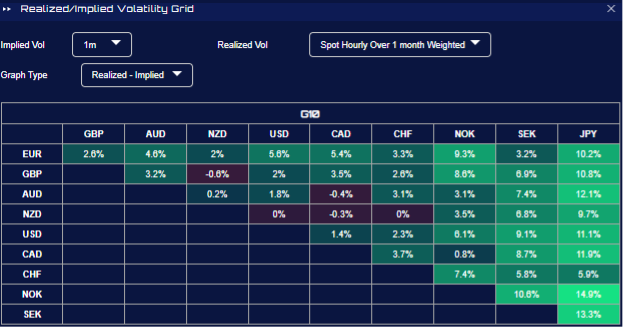

- Then we check how it looks on an hourly basis, giving a higher weighting to the most recent data.

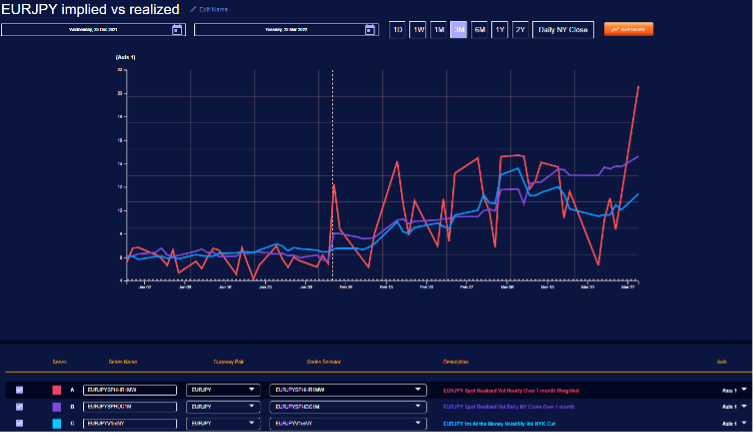

- The charting tool can be used to understand what has happened over time.

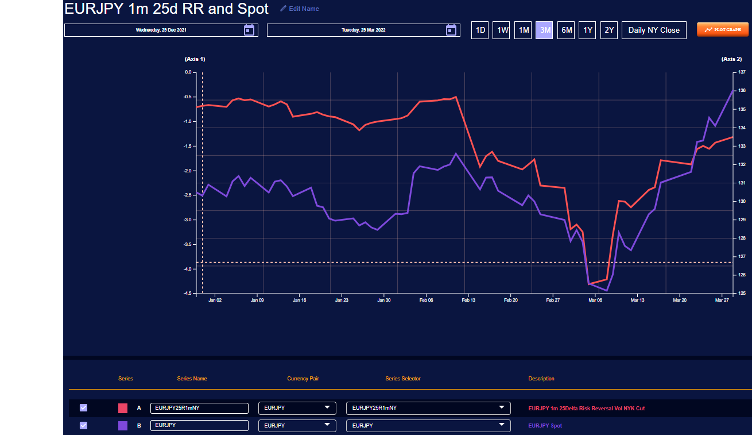

- We can also check spot and risk reversals. We can see that they are back to where they were before the invasion.

The large move-in spot and the realized vol performance could be an argument for being long options.

Buying EUR puts could be attractive, but which to buy?

Optimus can help you decide.

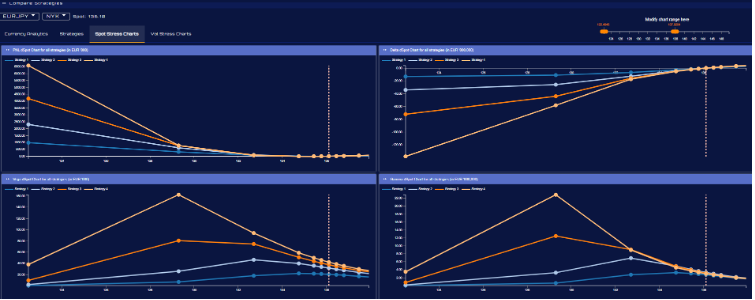

Here we compare four different options with similar premium spends (we can afford a larger notional on a lower delta option for the same total premium). The PNL and Greeks are displayed in both table and graph form.

Contact Us

If you would like to use SynOption for your own idea construction, please contact [email protected] to set up a demo or start onboarding. Synoption provides a market analytics and trade execution platform called Optimus.

All tools and analytics in the blog above are available on the Optimus platform.

Disclaimer

This document does not express the views of SynOption or any of its representatives and is not meant to be financial advice. The purpose of this document is to highlight how to use the Optimus platform for the construction of trade ideas based on client views. SynOption does not intend to induce any person to buy, sell or hold a particular investment product or a class of investment products. The information is meant purely for informational purposes and should not be relied upon as financial advice. SynOption will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Leave a Reply